Rate Lock Volume Continues To Drop

Year-over-year total lock volume falls by nearly 50%

- MCT’s rate lock activity indices are based on actual locked loan volume, not applications.

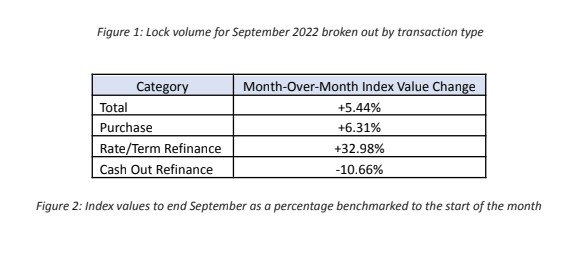

- Total mortgage rate locks by dollar volume fell 5.4% month-over-month in September.

Mortgage lock volumes continue to drop when compared to the summer of 2021, according to MCT.

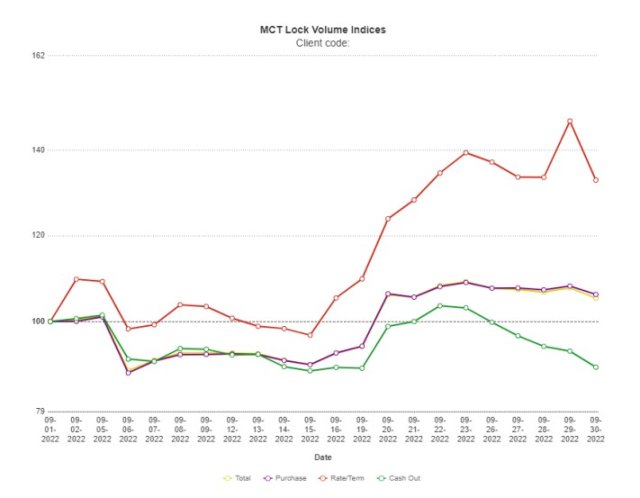

The company found that overall lock volumes were down 48.5% year-over-year. However, both the month-over-month rate/term refinance locks were up 33% and the purchase index was up 6.3% in September.

Total mortgage rate locks by dollar volume fell 5.4% month-over-month in September. Cash out refinances are down 10.7% month-over-month and from one year ago volume is down 80.6%, while rate/term refinance volume dropped 92.9% from 2021. Loan sizes were up 8.3% over the past year, with the average loan amount increasing $292,000 to $31,000.

MCT, provider of capital markets software and services, said it represents a balanced cross section of several hundred lenders among retail, correspondent, wholesale, and consumer direct channels. The Lock Volume Indices is broken out by transaction type: purchase, rate/term refinance, and cash out refinance.

MCT’s rate lock activity indices are based on actual dollar volume of locked loans, not number of applications. Especially in a tight purchase market, MCT relieves its methodology of using actual loans locked versus applications as a more reliable metric. There is a higher likelihood of having multiple applications per funded loan, and prequels do not convert at as high of a rate in the current market as has historically been the case — especially when applications are counted at the early stage of entering a property address.