Markets Ebb And Flow

Still, the wholesale market has seen churn before. And UWM’s actions alone aren’t wholly responsible for other companies’ withdrawal. When the market improves, others will inevitably tip-toe back into the pool. Some already have. Jet Mortgage, for instance, announced in October that it is launching a new wholesale initiative.

In 2021, mortgage lending was a $4.2 trillion market. Estimates for 2022 and 2023 say it will be closer to $2 trillion. With market lending capacity estimated at about $3 trillion currently, that leaves a lot of room for additional shrinkage, regardless of UWM’s rate moves.

And others argue that wholesaling may devolve into even more specialty niches. Keith Lind, CEO at Acra Lending, pointed out that the mainstream price wars “aren’t affecting us as much since we’re in the non-QM space. My opinion is that there’s been some capitulation for the people that were trying to drive volume throughout the last eight, nine months, and probably realized that the rate move has been violent.”

At Maryland-based ACC Mortgage, Chief Lending Officer Robert Senko is not as worried about the wholesale price war as others because its main product is Non-QM loans. “We’re not a direct competitor with UWM, but the pain is felt throughout the industry as a whole,” he said.

Senko predicts that conventional lenders will continue to be affected by the razor thin margins that are likely to shrink more and that some of them won’t make it through the next six months. Those that survive will have to join forces with others.

“You’re going to see a lot of [mergers and acquisitions]. People have had to take on more debt to ride out their mistakes.”

A Tighter Grip

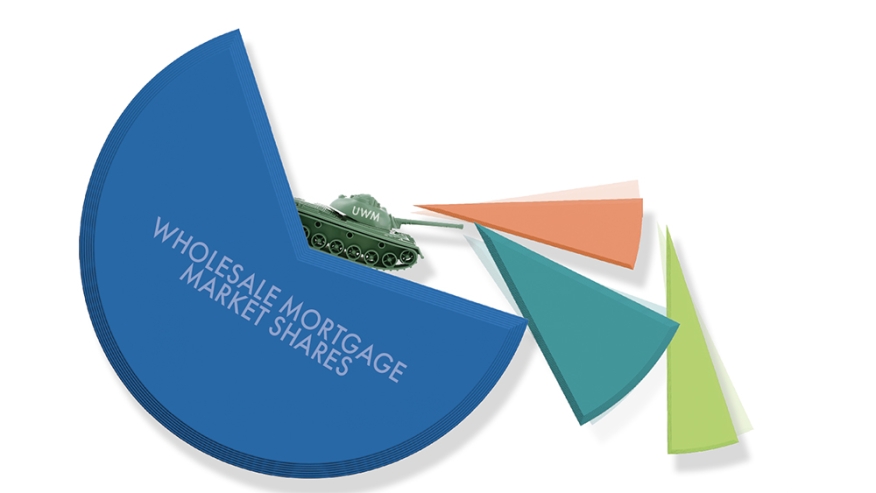

In the end, whether wholesale options increase or decrease for brokers, the net result is that UWM is expected to end up with an even greater share of the market. And that, say industry observers, is likely the whole point. Indeed, as analyst Brian Heal or Argus Research sees it, UWM is playing the long game.

“If they scratch out a couple of pennies or lose a couple of pennies [in the next quarterly earnings report], I think if they gain market share and then just say, OK, we’re going to return things to normal and we’ve put enough guys out of business, and we’re going from 35% of the wholesale market and we’re going to be at 50%, I think they’d be happy with that,” he said.

As for UWM’s tactics, Senko said their efficiencies separate them. “They are becoming a machine, the 800-pound gorilla in the room,” he said. “Not a great culture, just a machine.”

Anthony Simeone, chief lending officer for Ridgeway Savings Bank in Queens, N.Y., says his institution shares that approach of not rattling sabers with the big outfits. “We try to stay competitive within certain parameters, but I don’t tell my loan officers, ‘Hey, listen, go out there and see what the mortgage banks are offering and if we’re a little higher, go match it.’”

“We anticipate being close to $500 million by the end of this year,” he said. “About 70% of all of our [mortgage] business today is mortgage broker-driven.”

Andy Harris, president of Oregon-based Vantage Mortgage Brokers, sees a boom-and-bust situation.“I can tell you that … price wars of the past have been temporary with these two lenders and always strategic by nature,” he said. “Historically, many other wholesale lenders have been priced more competitively at a consistent level and I see an opportunity for smaller and mid-size wholesale lenders that step up to compete in the future — as in the past —but many failed to do so. As we know, these cycles can massively change and today is an example of that. I anticipate we’ll see similar lender attrition to 2008, but for many different reasons.”