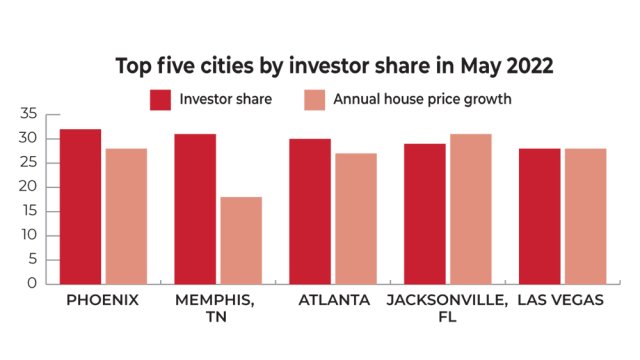

However, as the adage goes, correlation is not causation. Investor purchases could be driving price appreciation, or it could be the other way around, or both. There could also be a third factor driving both the growing investor share of purchases and house price appreciation simultaneously — a pandemic-driven surge in housing demand against a limited supply of homes for sale. It’s difficult to know with a high degree of certainty, but recent history provides some insight.

Pandemic-Priced Properties

The recent growth in demand to own residential properties is, in part, a consequence of a pandemic-induced flight away from densely populated cities and corresponding increase in demand for remote working space. This migration to more suburban cities and the search for more space accelerated demand in key markets, contributing to record house price appreciation.

As people became priced out of the purchase market, they turned to the rental market, which in addition to ongoing new rental household formation, contributed to rents growing at a record pace. The combination of rapid rent growth and house price appreciation attracted even more investors flush with capital. This explanation is compelling in part because annual house price growth was already in the double digits before the investor share picked up in the second half of last year. In other words, there’s a strong case to be made that house price growth was influential in driving up the investor share.

Rising investor participation in the residential housing market created additional competition for the already-limited number of homes available for purchase, compounding the already-rapid pace of price growth. One estimate for the current national shortage in housing units is 3.8 million units. This pre-existing shortage made house prices highly responsive to the increased demand from investors.

Permanent Phenomenon Or Passing Phase?

If greater investor participation continues to contribute to elevated demand relative to limited supply, then house prices are likely to remain positive despite rising interest rates. If house price growth is enticing greater investor participation, then we would expect to see declining investor participation in the residential housing market as house prices decelerate. Currently, investor participation remains near all-time highs, but mortgage purchase applications were down 16% year-over-year in a late-July report, indicating a declining buyer pool for potential homes that may translate to slower price growth in the near term.

However, the ongoing housing shortage will continue to make home prices particularly responsive to changes in demand. So, which came first, greater investor participation or faster house price growth? Perhaps, neither. It seems that both were predated by pandemic-accelerated demand amid a historic supply shortage.