More Info The Better

Yet, McKenna says he’s not sure if mortgage lenders are aware of this issue. Unless the lender has history with the borrower, it would have no way of knowing their credit score is illegitimate once it’s been successfully added to the system.

The more information the lender has about the borrower, the better it’ll be able to determine whether identity theft claims are truthful or not. But since so many homeowners refinanced in the past two years, possibly with a new lender, borrower information would be harder to track. Borrowers with fake credit scores might try to do a cash-out refinance, but this fraud mainly occurs among borrowers looking to purchase a home.

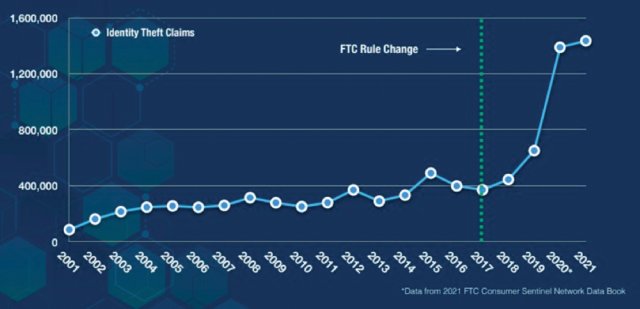

The investigators in charge of validating these claims for identity theft found that 98% were not legitimate, according to data collected by Point Predictive.

“Basically, the consumer or the credit repair company on behalf of the consumer was disputing claims that were illegitimate,” said McKenna. “This created a big opportunity for credit repair companies to make a lot of money for borrowers who can’t get into homes or buy cars. So, they started to advertise that they could help consumers get homes and cars and fix their credit in about 30 days. And they made a ton of money doing so.”

Non-credit savvy consumers end up falling for these advertisements because they are desperate to improve their credit score in order to get a loan on a car or home. Recently, the FTC filed a lawsuit against a Houston-based company Turbo Solutions, formerly known as Alex Miller

Financial Services Inc., which has done business as Alex Miller Credit Repair. The owner, officer, director, and manager of Turbo Solutions, Alex Miller, who would go directly on the FTC website and fill out forms on behalf of the consumer.

The lawsuit states that, “Defendants falsely claim that, for a fee ranging from several hundred dollars to more than $1,500, they can improve consumers’ credit scores. Defendants attempt to improve the credit scores of their customers by filing false identity theft reports on the FTC’s identitytheft.gov website and by other means, all of which are either ineffective or unlawful.”

Although Alex Miller’s company website seems to be taken down, his Instagram account is still advertising to consumers. Most of the posts show Miller standing in front of expensive cars, sporting gold watches, with a caption claiming that consumers could afford the same lavish lifestyle by allowing him to improve their credit score.

Even with a lawsuit pending, Miller continues to advertise on social media. “They taking [sic] my baby away,” he stated, referring to the FTC, and “I ain’t did nothing but try to help people.”

It does not take a sophisticated scammer to commit credit-washing fraud. According to McKenna, borrowers or credit repair companies don’t have to do much to dispute a claim; all of the onus is on the lenders to prove whether it’s legitimate or not.

“Miller, for instance, would advertise ‘Your score will increase according to the positive accounts you have after I delete all the negatives.’ So, he’s removing all the negative stuff while adding authorized tradelines to the consumers ’bureau,” McKenna explained. “So for a fee of $250 they’ll boost your credit with other tradelines.”

Credit tradelines are accounts that appear on your credit reports, such as credit cards, auto loans, and a mortgage. These tradelines provide much of the data used to create a consumer’s credit score. A tradeline is an entry on a credit report, so every time a consumer opens an account with a creditor that reports to the credit bureau, the credit bureau opens a tradeline on the consumer’s credit report.